Understanding South African banks routing numbers is crucial for anyone dealing with financial transactions within the country or internationally. These routing numbers, also known as clearing codes, play a pivotal role in ensuring that funds are directed to the correct bank and branch. Without accurate routing numbers, payments can be delayed or even lost in the system. Whether you're transferring money domestically or receiving funds from abroad, having the correct routing number is essential for smooth financial operations. As South Africa's banking sector continues to evolve, staying informed about these numbers is more important than ever.

In today's interconnected financial world, the importance of routing numbers cannot be overstated. They act as a digital address for banks, ensuring that transactions are processed accurately and efficiently. For individuals and businesses operating within South Africa, knowing the specific routing numbers for each bank can save time and prevent costly errors. This guide aims to provide comprehensive information on South African banks routing numbers, helping users navigate the complexities of the banking system with confidence.

As the financial landscape continues to change, the demand for accurate and up-to-date information on routing numbers grows. With advancements in technology and the rise of digital banking, having access to reliable data is essential. This article delves into the specifics of South African banks routing numbers, offering insights and tips for ensuring seamless transactions. By understanding the role and function of these numbers, users can enhance their financial management and avoid potential pitfalls.

Read also:St Hedwig A Comprehensive Guide To Her Life Legacy And Impact

What Are South African Banks Routing Numbers?

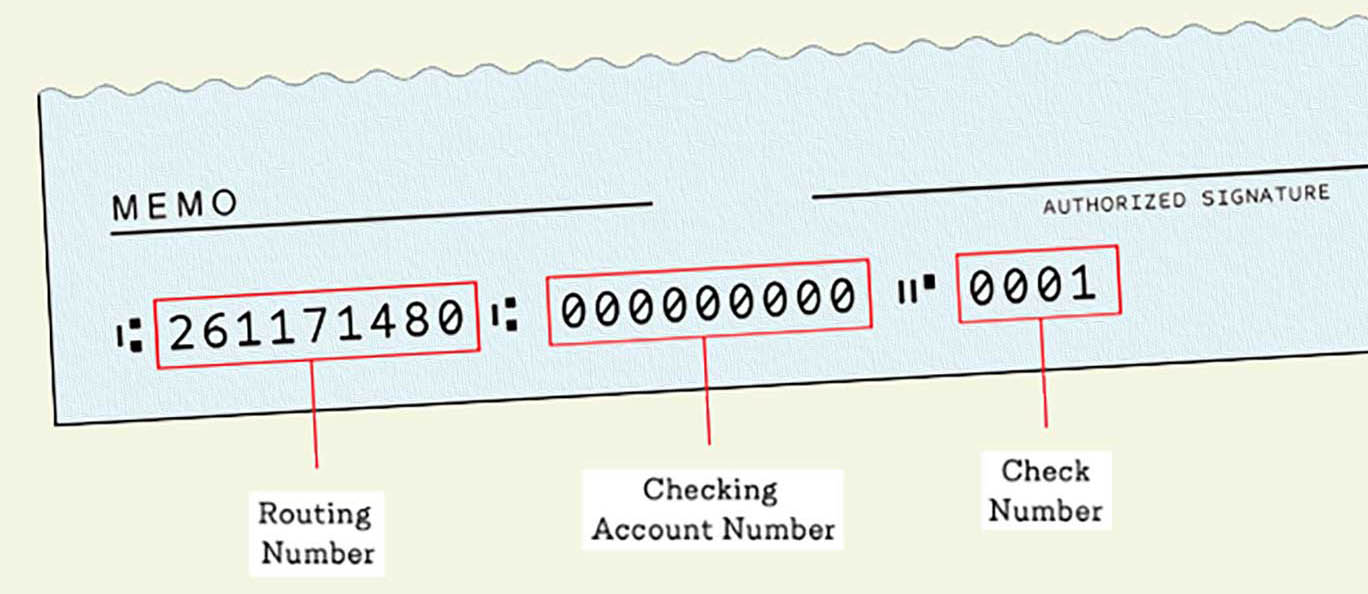

South African banks routing numbers are unique identifiers assigned to each bank and branch within the country. These numbers are used to facilitate domestic and international transactions, ensuring that funds are directed to the correct destination. The routing number system in South Africa is designed to streamline financial operations, making it easier for individuals and businesses to manage their accounts effectively.

Why Are South African Banks Routing Numbers Important?

The importance of South African banks routing numbers lies in their ability to ensure accurate and timely transactions. Without these numbers, payments may be delayed or sent to the wrong account. By using the correct routing number, users can avoid unnecessary complications and ensure that their financial transactions are processed smoothly. This is particularly important for businesses that rely on regular payments and transfers to maintain their operations.

How Do South African Banks Routing Numbers Work?

The functioning of South African banks routing numbers is relatively straightforward. Each number is unique to a specific bank and branch, allowing financial institutions to identify the origin and destination of a transaction. When initiating a transfer, users are required to provide the routing number of the recipient's bank, ensuring that the funds are directed to the correct account. This system is designed to minimize errors and enhance the efficiency of financial transactions.

Which Banks Use South African Banks Routing Numbers?

All major banks in South Africa utilize routing numbers to facilitate transactions. These include well-known institutions such as Standard Bank, Absa, Nedbank, and First National Bank (FNB). Each bank assigns unique routing numbers to its branches, ensuring that funds are directed accurately. For individuals and businesses operating within South Africa, having access to these numbers is essential for managing their finances effectively.

Where Can You Find South African Banks Routing Numbers?

Finding South African banks routing numbers is relatively simple. Most banks provide this information on their official websites, making it easy for users to access the necessary details. Additionally, users can contact their bank's customer service department for assistance in obtaining the correct routing number. It is important to verify the accuracy of the number before initiating any transaction to avoid potential errors.

What Happens If You Use the Wrong Routing Number?

Using an incorrect routing number can result in significant delays or even the loss of funds. If the number provided does not match the recipient's bank and branch, the transaction may be rejected or sent to the wrong account. To prevent this, users should double-check the routing number before initiating any transfer. In cases where an error has occurred, contacting the bank's customer service department can help resolve the issue and recover the funds.

Read also:Discover The Excitement At Sunset Station Casino Henderson Nevada A Complete Guide

Can You Change South African Banks Routing Numbers?

Routing numbers are assigned by the bank and cannot be changed by the user. However, if a bank merges with another institution or undergoes restructuring, the routing numbers may be updated. In such cases, users will be notified of the changes and provided with the new routing numbers. It is important to stay informed about any updates to ensure that financial transactions are processed without interruption.

How Do South African Banks Routing Numbers Impact International Transactions?

When dealing with international transactions, South African banks routing numbers play a crucial role in ensuring that funds are directed to the correct bank and branch. These numbers are used in conjunction with SWIFT codes to facilitate cross-border payments. By providing the correct routing number, users can avoid delays and ensure that their transactions are processed efficiently. This is particularly important for businesses that rely on international payments to maintain their operations.

What Should You Consider When Using South African Banks Routing Numbers?

When using South African banks routing numbers, it is important to consider several factors to ensure a smooth transaction. These include verifying the accuracy of the number, understanding the bank's processing times, and being aware of any associated fees. Additionally, users should ensure that they have all the necessary information, such as the recipient's account number and bank details, before initiating the transfer.

Table of Contents

- What Are South African Banks Routing Numbers?

- Why Are South African Banks Routing Numbers Important?

- How Do South African Banks Routing Numbers Work?

- Which Banks Use South African Banks Routing Numbers?

- Where Can You Find South African Banks Routing Numbers?

- What Happens If You Use the Wrong Routing Number?

- Can You Change South African Banks Routing Numbers?

- How Do South African Banks Routing Numbers Impact International Transactions?

- What Should You Consider When Using South African Banks Routing Numbers?

- Conclusion: The Importance of Staying Informed

Conclusion: The Importance of Staying Informed

In conclusion, understanding South African banks routing numbers is essential for anyone dealing with financial transactions within the country or internationally. These numbers play a crucial role in ensuring that funds are directed accurately and efficiently, minimizing the risk of errors and delays. By staying informed about the latest developments and updates in the banking sector, users can enhance their financial management and avoid potential pitfalls. As the financial landscape continues to evolve, staying up-to-date with routing numbers and other banking information is more important than ever.