Personal banking in Lubbock offers residents a wide array of financial solutions tailored to their unique needs. Whether you're looking to manage daily transactions, save for the future, or secure loans, local banks in Lubbock provide personalized services to help you achieve your financial goals. In today's fast-paced world, having access to reliable and efficient banking services is essential, and Lubbock's financial institutions stand ready to assist you every step of the way.

With a growing economy and a vibrant community, Lubbock has become a hub for financial innovation. Banks in the area offer cutting-edge technology, competitive interest rates, and dedicated customer service. Whether you're a student, professional, or retiree, personal banking in Lubbock can help you navigate your financial journey with confidence and ease.

As you explore the options available to you, it's important to consider what features and benefits align with your personal financial objectives. From mobile banking apps to specialized savings accounts, Lubbock's banks cater to a diverse clientele. This article will guide you through the various aspects of personal banking in Lubbock, helping you make informed decisions about your financial future.

Read also:Tropicana Showroom Atlantic City Your Ultimate Guide To Entertainment And Fun

What Should You Look for in Personal Banking in Lubbock?

When evaluating personal banking options in Lubbock, several key factors should be taken into account. First and foremost, consider the accessibility of the bank's services. Many banks now offer mobile banking apps, allowing customers to manage their accounts from anywhere. Additionally, look for banks that provide no-fee checking accounts, competitive interest rates on savings, and a robust network of ATMs to avoid unnecessary charges.

Customer service is another crucial element. A reputable bank will have knowledgeable staff ready to assist you with any questions or concerns. Furthermore, ensure the bank offers the specific products you need, such as mortgages, auto loans, or credit cards. By carefully assessing these aspects, you can find a personal banking solution that aligns perfectly with your lifestyle and financial goals.

How Can Personal Banking in Lubbock Help You Save Money?

Saving money is a top priority for many people, and personal banking in Lubbock can play a pivotal role in achieving this objective. Many local banks offer high-yield savings accounts that allow you to grow your wealth over time. Additionally, budgeting tools and financial planning resources are often available to help you track expenses and identify areas where you can cut costs.

One of the most effective ways to save is by automating your savings. Many banks in Lubbock enable you to set up automatic transfers from your checking account to your savings account. This simple step ensures that you consistently contribute to your savings without having to think about it. Moreover, by leveraging the expertise of local banking professionals, you can develop a comprehensive savings strategy tailored to your unique circumstances.

Why Is Personal Banking in Lubbock Important for Your Financial Health?

Your financial health is as important as your physical health, and personal banking in Lubbock can significantly impact it. A well-managed banking relationship helps you maintain a strong credit score, which is crucial for securing loans, mortgages, and other financial products at favorable rates. Additionally, banks in Lubbock offer tools and resources to help you budget effectively, reduce debt, and build wealth over time.

Investing in a reliable personal banking relationship is an investment in your financial future. By partnering with a trusted bank, you gain access to expert advice and resources that empower you to make sound financial decisions. Whether you're planning for retirement, buying a home, or funding your children's education, personal banking in Lubbock can provide the foundation you need to achieve your dreams.

Read also:Exploring Movirulz The Ultimate Guide To Online Movie Streaming

What Are the Top Personal Banking Options in Lubbock?

Lubbock boasts a variety of banking institutions, each offering its own unique set of services and benefits. Some of the top options include local credit unions, national banks, and community-focused financial institutions. Each of these entities brings something different to the table, so it's important to evaluate them based on your specific needs.

Local credit unions often provide personalized service and lower fees, while national banks may offer more advanced technology and a wider range of products. Community-focused banks, on the other hand, prioritize supporting local businesses and residents. By exploring these options, you can find the perfect personal banking solution for your situation.

How Does Personal Banking in Lubbock Support Local Businesses?

One of the key strengths of personal banking in Lubbock is its commitment to supporting local businesses. Many banks in the area offer specialized products and services designed to help small businesses thrive. These include business checking accounts, merchant services, and commercial loans. By partnering with a local bank, business owners can access the capital and resources they need to grow and succeed.

Furthermore, personal banking in Lubbock often involves community outreach programs that benefit both businesses and residents. These programs may include financial literacy workshops, mentorship opportunities, and networking events. By engaging with these initiatives, you can strengthen your ties to the community and enhance your financial well-being.

What Are the Benefits of Online Banking in Lubbock?

Online banking has revolutionized the way people manage their finances, and Lubbock's banks are at the forefront of this trend. By utilizing online banking services, you can check your balances, pay bills, and transfer funds from the comfort of your home. Many banks also offer mobile apps that allow you to conduct transactions on the go, providing unparalleled convenience and flexibility.

In addition to these practical benefits, online banking often comes with enhanced security features, such as two-factor authentication and fraud protection. This ensures that your financial information remains safe and secure. As you explore personal banking in Lubbock, be sure to inquire about the online services offered by each institution to ensure they meet your needs.

Which Personal Banking Services Are Ideal for Students in Lubbock?

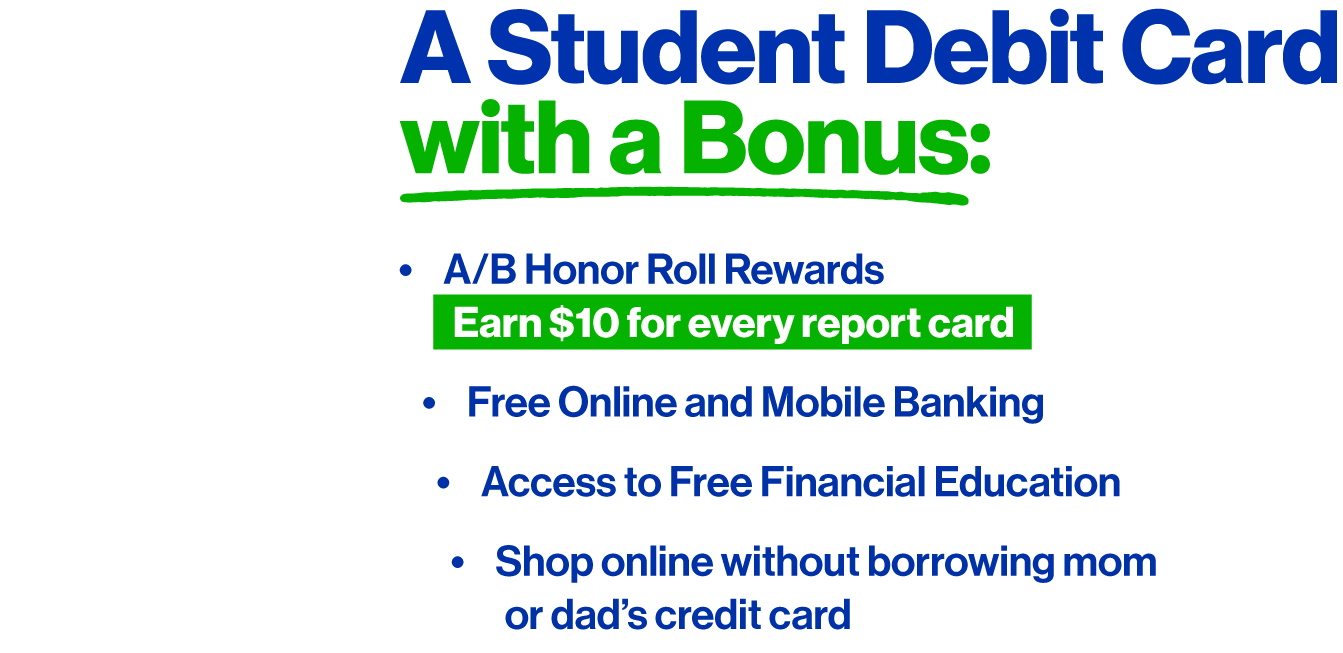

Students in Lubbock have unique financial needs that require specialized banking solutions. Many banks in the area offer student checking accounts with no monthly fees, low minimum balance requirements, and access to financial education resources. These accounts are designed to help students manage their finances effectively while they pursue their studies.

Additionally, some banks provide student loans at competitive rates, making it easier for students to finance their education. By establishing a strong banking relationship early on, students can build a solid financial foundation that will serve them well throughout their lives. As you explore personal banking in Lubbock, consider the services offered to students and how they can benefit you.

Can Personal Banking in Lubbock Assist with Retirement Planning?

Retirement planning is a critical aspect of personal finance, and personal banking in Lubbock can offer valuable assistance in this area. Many banks provide a range of retirement savings options, including IRAs, 401(k) plans, and annuities. These products are designed to help you accumulate wealth over time and ensure a comfortable retirement.

Furthermore, banks in Lubbock often employ financial advisors who specialize in retirement planning. These professionals can help you develop a comprehensive strategy that takes into account your income, expenses, and long-term goals. By leveraging the expertise of local banking professionals, you can create a retirement plan that meets your unique needs and aspirations.

How Can Personal Banking in Lubbock Help with Debt Management?

Debt management is a common challenge for many people, and personal banking in Lubbock can provide the tools and resources needed to address it effectively. Many banks offer debt consolidation loans, which allow you to combine multiple debts into a single payment with a lower interest rate. This can simplify your financial life and reduce the overall cost of borrowing.

In addition to loan products, banks in Lubbock often provide financial counseling services to help customers develop strategies for paying down debt. These services may include budgeting advice, credit score improvement tips, and debt reduction plans. By working closely with your bank, you can take control of your debt and achieve financial freedom.

Table of Contents

- Maximizing Your Finances with Personal Banking in Lubbock

- What Should You Look for in Personal Banking in Lubbock?

- How Can Personal Banking in Lubbock Help You Save Money?

- Why Is Personal Banking in Lubbock Important for Your Financial Health?

- What Are the Top Personal Banking Options in Lubbock?

- How Does Personal Banking in Lubbock Support Local Businesses?

- What Are the Benefits of Online Banking in Lubbock?

- Which Personal Banking Services Are Ideal for Students in Lubbock?

- Can Personal Banking in Lubbock Assist with Retirement Planning?

- How Can Personal Banking in Lubbock Help with Debt Management?

In conclusion, personal banking in Lubbock offers a wealth of opportunities for individuals seeking to enhance their financial well-being. From saving money and managing debt to planning for retirement and supporting local businesses, the services provided by Lubbock's banks are diverse and effective. By carefully evaluating your options and establishing a strong banking relationship, you can achieve your financial goals and secure a prosperous future.